Our Closing Process For Home Loans Diaries

After signing these records, you end up being responsible for the home loan. Familiarize yourself with several of the crucial documents you will be signing to make sure that you understand what to look for when you get them. If you're acquiring a house with a lending, the closing of your lending (the moment when your car loan becomes final and the funds are dispersed) as well as the closing of your house acquisition (when you end up being owner of your new house) generally take place at the same time.

Your closing might consist of some or all of these entities: Your property agent or real estate professional Your title insurer An escrow firm Your lawyer (if you come from a state where lawyers perform closings, or if you employ lawful depiction for your closing) The vendor's lawyer Your lender might or may not go to Relying on what state you stay in, all the parties may kick back a table as well as sign all the records at the same time.

The 9-Minute Rule for Steps In Shutting A Home Mortgage

Some business permit you to online authorize documents, either in advancement of closing or at the closing table. A closing might also be carried out by mail or perhaps on the web. Despite who performs the closing or where it occurs, there will certainly be numerous important files that you'll require to sign that will certainly have enduring economic effects on your life.

Do not authorize the loan files if the financing is different from what you expected. Do not sign the papers if you can't make the payments, if you discover any errors, or if you do not understand the car loan terms. Be certain to comprehend just how your settlements might alter gradually. With an adjustable-rate home loan, your repayments may enhance gradually, and also it is necessary to recognize when the repayment can transform as well as by how much.

Not known Facts About Closing A Mortage

Whether you're a first-time property buyer, looking to acquire a 2nd house, or scaling down after a life change, you can't relocate into your new home till you officially close on the building. Your closing day-- the day you consult with the seller, your property agents, title or escrow representatives, and perhaps various other celebrations involved in the purchase-- is the day the building formally becomes your own.

That's commonly 30 to 60 days prior to your actual closing day-- assuming a car loan underwriting grab, reduced assessment, or major problem found throughout a regular house evaluation does not delay the deal. Throughout this period, the sale of your residence is claimed to be "pending." If it's popular in your market to make a significant deposit (approximately 10% of the concurred purchase price, in many cases) right into an escrow account once your deal is accepted, you may additionally refer to the closing process as the escrow period-- as in, "the house we're acquiring is in escrow up until our closing day." Enroll in the Capital One ® Savor ® Cash Money Incentives Charge card currently and obtain a $300 reward after investing $3k within 3 months.

Excitement About Shutting Procedure For Home Loans

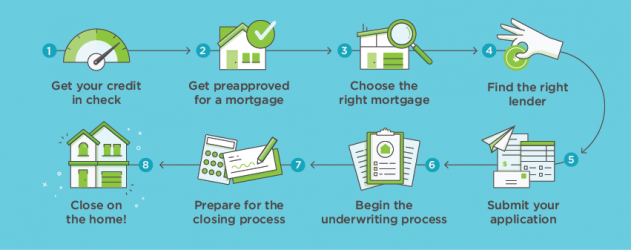

Figure out just how to use right here. Regardless of what you call it, a great deal requires to occur between the day the seller approves your purchase deal as well as the day you take a seat to make the purchase official. Right here's a take a look at the basic series of occasions that take place during the residential property closing procedure, what and also just how much you can anticipate to pay previously as well as on your closing day, and the files as well as disclosures you need to comprehend and also authorize to make your property transaction official.

Our closing day was a whirlwind: a chaotic last walk-through; a traffic-choked drive to the title company's far-off headquarters; an endless procession of forms and disclosures to be signed and also initialed; the confusing jumble of keys, handwritten notes of description, as well as last-minute recommendations from the vendor-- it was a whole lot to process.

Some Ideas on Home Mortgage Closing Procedure You Need To Know

All we can really hope is that we channel the very same diligence, organization, and also raw power that obtained us through to shutting day right into the difficult, usually laborious work called for to turn a normal house right into a remarkable home. If you remain in the process of buying a house, keep in mind that it's flawlessly fine to celebrate on closing day-- as long as you solve back to function later.

Jetta Productions/Getty Images Closing day is an interesting occasion for buyers. If everything goes smoothly, it normally finishes with a salute and also a new collection of secrets. The closing is when the customer and vendor sign the papers formally sealing the deal, as well as possession of the residential or commercial property is moved. It's likewise your last opportunity as the purchaser to make any last modifications to the transaction.

Indicators on Shutting Procedure For Mortgages You Need To Know

One of them is to assess the closing disclosure. The closing disclosure outlines the terms of your finance; last closing prices; and also any kind of exceptional fees or fees. Your lending institution will certainly send you this form at least three days prior to shutting. As soon as the consumer indications the closing disclosure, there's a three-day waiting period before they can sign the home loan records, says Buzz Dempsey, elderly finance officer at The Dempsey Group at VIP Home mortgage based in Tucson, Arizona.

" This way they can review them prior to they go to the escrow firm to sign the records." Pre-closing, customers need to also do a last walk-through of the residential or commercial property. The goal of the walk-through is to confirm that all agreed-upon fixings were made, that the seller has actually abandoned the home as well as that your home remains in the order you anticipated.

What Does Action In Shutting A Home Loan Do?

If there are considerable troubles, you can ask to delay the closing or demand that the vendor down payment money right into an escrow account to cover the necessary fixings. You'll additionally wish to make setups to transfer the energies in your name reliable the day of closing, Dempsey claims. At closing, your engagement will involve a number of actions: Sign lawful papers.

Be sure to read all records very carefully prior to authorizing them, as http://marymasonisgo016.fotosdefrases.com/weak-may-jobs-growth-keeps-mortgage-rates-insanely-low-the well as do not sign types with empty lines or areas. Pay shutting prices and escrow products. There are numerous charges related to obtaining a home loan and also moving residential property ownership. You might likewise have the ability to wrap the closing charges right into the finance balance.

How Shutting Process For Mortgages can Save You Time, Stress, and Money.

So they have to bring funds in an appropriate kind," Dempsey claims. "That's typically a cashier's check constructed to the escrow business or they wire transfer funds to the banking institution." Be sure to find out what kind of recognition is required. Usually, just one kind of recognition is required, though some business call for two.

Closing treatments vary from state to state and even region to county, however the complying with parties will typically be present at the closing or negotiation conference: Closing representative, that may benefit the lender or the title firm. Attorney: The closing agent could be a lawyer representing you or the lender.

The Facts About Shutting Procedure For Mortgages Revealed

It's always a good idea to have an attorney present who represents you and only you. Title firm agent, who provides written proof of the ownership of the residential property. House seller. Seller's actual estate agent. You, also called the debtor. Loan provider, likewise known as the mortgagee. The closing agent performs the settlement meeting and also makes sure that all documents are signed and also taped and that closing charges as well as escrow repayments are paid as well as appropriately dispersed.

This record includes crucial details regarding your lending, including terms, interest price as well as closing costs. Make certain all the information is proper, including the punctuation of your name. The closing disclosure. Like the car loan price quote, the closing disclosure lays out details of your home loan. You should get this type at least three days prior to closing.